Types of Monthly Expenses and Creating a Monthly Budget

Although monthly expenditures vary based on where you live and the lifestyle you choose, the average cost of living in America is between $2,500 and $3,500 per month. As Forbes reported, total average annual expenditures range from $32,336 in Mississippi to $55,491 in Hawaii.

Regardless of location and income, keeping track of your monthly expenses and creating a monthly budget to help you stay on track with your financial goals is important. From the financial professionals at Tower Loan, here is a monthly expenses list, budget examples, and tips to help you establish and stick to a budget that’s right for you.

Monthly Expenses List

What are monthly expenses? They are costs associated with day-to-day living that you pay to feel safe, secure, and happy. Modern life comes with many monthly bills to pay, which can feel overwhelming if you don’t have a handle on your finances or if your expenditures are greater than your income.

Here is a monthly expenses list to help you get organized with your budget:

Housing

For many people, housing is the most significant monthly expenditure for rent or mortgage payments. If you own your home, also factor in property taxes and maintenance costs. If you rent, consider your security deposit, renter’s insurance, and household costs your landlord doesn’t cover.

Transportation

Your transportation expenditures include your personal vehicle costs, such as car payments, gas money, and routine maintenance costs. If you take public transportation to commute to work or for daily activities, factor in train and bus fares.

Food

It’s wise to create a monthly food budget for you and your family to get an idea of how much you spend on groceries and dining out. Cooking meals and eating at home is generally more economical than going out to restaurants daily, and food costs are monthly expenses that you can often cut back on if necessary.

Utilities

Regardless of whether you rent or own your home, utility costs make up a significant portion of monthly expenses. These costs typically include propane or natural gas for heat and electricity for cooling, lights, and appliances. Other utility costs include your water and sewer bill and trash collection bill.

Technology

Modern life revolves around technology, so you might be paying considerably more for your devices and services than a few years ago. Technology expenses include your cell phone, internet, cable TV, and streaming services. They can also include subscription and membership fees that you pay to access certain apps for music, movies, and shows.

Children

Raising children involves many monthly expenses that evolve as your kids age and enter different life phases. Initially, you may be paying for babysitting or daycare, but those costs turn into tuition fees and extracurricular activity costs as your little ones grow up.

Pets

Pets must also be considered when creating your monthly budget, especially if you have a pet with health conditions or special needs. Pet monthly expenses may include food, treats, toys, dog walkers, pet sitters, pet insurance, and veterinary bills.

Personal Care

Living expenses also include the cost of clothing and personal grooming items, such as toiletries and haircare products. If you love to shop and keep up with the latest fashions, it’s a good idea to stick to a strict clothing budget so your finances remain intact.

Insurance

Various types of insurance are available to protect your finances in case of emergencies. One of the most important types of insurance is health insurance, which may be covered by your employer or be an individual plan you purchase. Monthly expenses also include life insurance, homeowner’s or renter’s insurance, car insurance, and pet insurance.

Entertainment

To enjoy life and have fun, make sure to keep room in your budget for entertainment. Dinners out, movie tickets, airline tickets, hotel costs, concert tickets, sporting event tickets, bar tabs, and hobby costs can all be added to your monthly expenses list for entertainment.

Savings

To plan ahead for your future, ensure that savings are a part of your monthly budget. Some financial experts recommend setting aside 10% to 20% of your income for savings, but try to put aside as much as possible to establish a good spending/saving balance.

Debt

Payments on debts that you owe are also monthly expenses and include credit cards, personal loans, and student loans. If you make monthly installment payments on your debt, this is an expense you can plan around when creating your budget.

Retirement

If you start saving for retirement as early as possible, you can earn more interest income over time. Financial planners often recommend saving 10% to 15% of your income for retirement through a 401k plan, IRA, or other retirement account.

Emergencies

When unforeseen circumstances strike, it is beneficial to have an emergency fund with accessible cash. Emergency funds are helpful if you are in an accident and face medical bills or your car breaks down. A personal loan can also help you handle unexpected situations if you haven’t budgeted enough for emergencies.

Interested in a Personal Loan from Tower Loan?

START YOUR APPLICATION TODAY!Want to get your questions answered first?

Fixed vs. Variable Monthly Expenses

Some monthly bills remain constant, while others fluctuate based on circumstances or the time of year. Monthly expenses remain steady, including insurance premiums, mortgage payments, and subscription services. Budgeting for these types of costs is easy because they are predictable and reliable.

Meanwhile, variable monthly expenses are constantly subject to change and are largely discretionary. Examples of variable expenses include groceries, travel, and entertainment costs. It may be easier to cut back on variable expenses if you feel a strain on your budget.

How to Create a Monthly Budget

To manage your monthly expenses, organize your financial details into a budget. List your expenses and their costs in a spreadsheet, and compare that list with your income to determine where there are opportunities to save more or reduce costs.

Every month, track your expenses and compare them to the budget you’ve created. You may need to adjust your spending habits if there are significant discrepancies between the two spreadsheets.

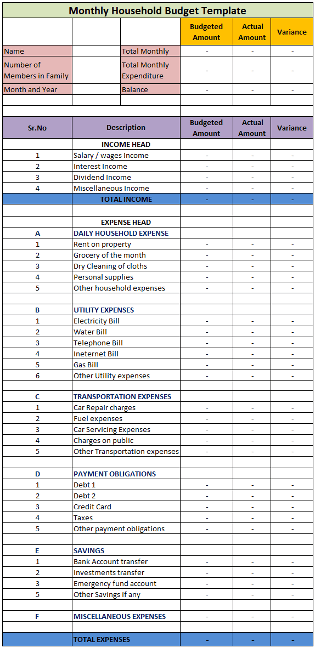

Monthly Budget Examples

Here is an example of a monthly budget template to inspire you to create a spreadsheet that makes sense with your financial obligations.

You can find Excel budget templates and monthly budget examples online to manage a general budget or expenses for specific purposes.

Click the image to enlarge the example.

Source: Monthly Household Budget Template (wallstreetmojo.com)

Tips for Managing Your Living Expenses

If you aim to spend less and save more while living comfortably and enjoyably, there are many ways to accomplish this with your monthly budget.

Here are some tips for managing your living expenses and getting control of your average monthly expenses:

- Use a free budget calculator to get started with your budget

- Keep accurate records of your spending

- Get everyone in your household involved with your budget

- Schedule bill payments on the days you get paid

- Know your credit score and when it changes

- Downsize and downgrade services when you can

- Compare and switch insurance providers to save money

- Sell items you no longer need

- Buy items in bulk or that are on sale

- Pick up temporary and seasonal work for extra income

- Pay your credit card balance in full each month, if possible

- Consider a personal loan when expenses are out of your budget

If a personal loan could help you get back on track with your budget, Tower Loan is here to help. Learn more about small personal loans on our helpful FAQ page, stop by your local branch office, or complete your loan application online.